CERRIX is exploring AI-driven innovations to enhance risk identification, data structuring, and compliance automation. Our upcoming Risk & Control Description Generator, powered by LLMs, will streamline documentation—ensuring consistency while saving teams valuable time.

The European Leading GRC Platform for Financial Services

Centralize Your Risk Data, Automate Compliance Processes

All-in-One GRC: Risk, compliance, audit & third-party oversight.

Scalable & Flexible: Grows with your business and regulatory needs.

AI-Driven Efficiency: Automate compliance & improve decisions.

Seamless Collaboration: Connect teams & regulators effortlessly.

Expert Support: Industry-backed guidance for compliance success.

Pricing starts from €1.875 per month

Solving Your Compliance, Risk Management, and Audit Challenges

Remove siloed risk & compliance data

Centralized risk, compliance, audit & third-party management.

Ensure compliance with ease

Simplify regulatory adherence with built-in compliance frameworks.

Increase visibility on risks

Proactive risk monitoring with real-time dashboards & alerts.

Eliminate manual reporting & audits

Provide real-time insights into control and risk assessment while performing audits with reliable, data-driven dashboards.

AI-Powered Compliance & Risk Management

CERRIX Core Modules

The Integrated GRCA Platform For Financial Services

Risks & Controls Management

Enable structured risk identification, assessment, and monitoring aligned with organizational risk appetite.

Incident Management

Track and analyze incidents to implement corrective actions and improve processes via customized workflows.

Process Management

Map, monitor, and assess processes to identify risks and implement controls effectively.

Compliance Management

Manages regulatory requirements, tracks compliance status, and integrates controls with risk assessments.

3rd Party Management

Assesses and monitors third-party risks, ensuring vendor compliance with organizational standards.

GDPR Management

Support the implementation of data processing, integrating privacy protection programs into enterprise risk and compliance management.

Audit Management

Streamline internal & external audit planning, execution, and reporting with a focus on traceability and effectiveness.

Real-time Reporting & Dashboard

Offer real-time analytics, dashboards, and reporting capabilities to support decision-making.

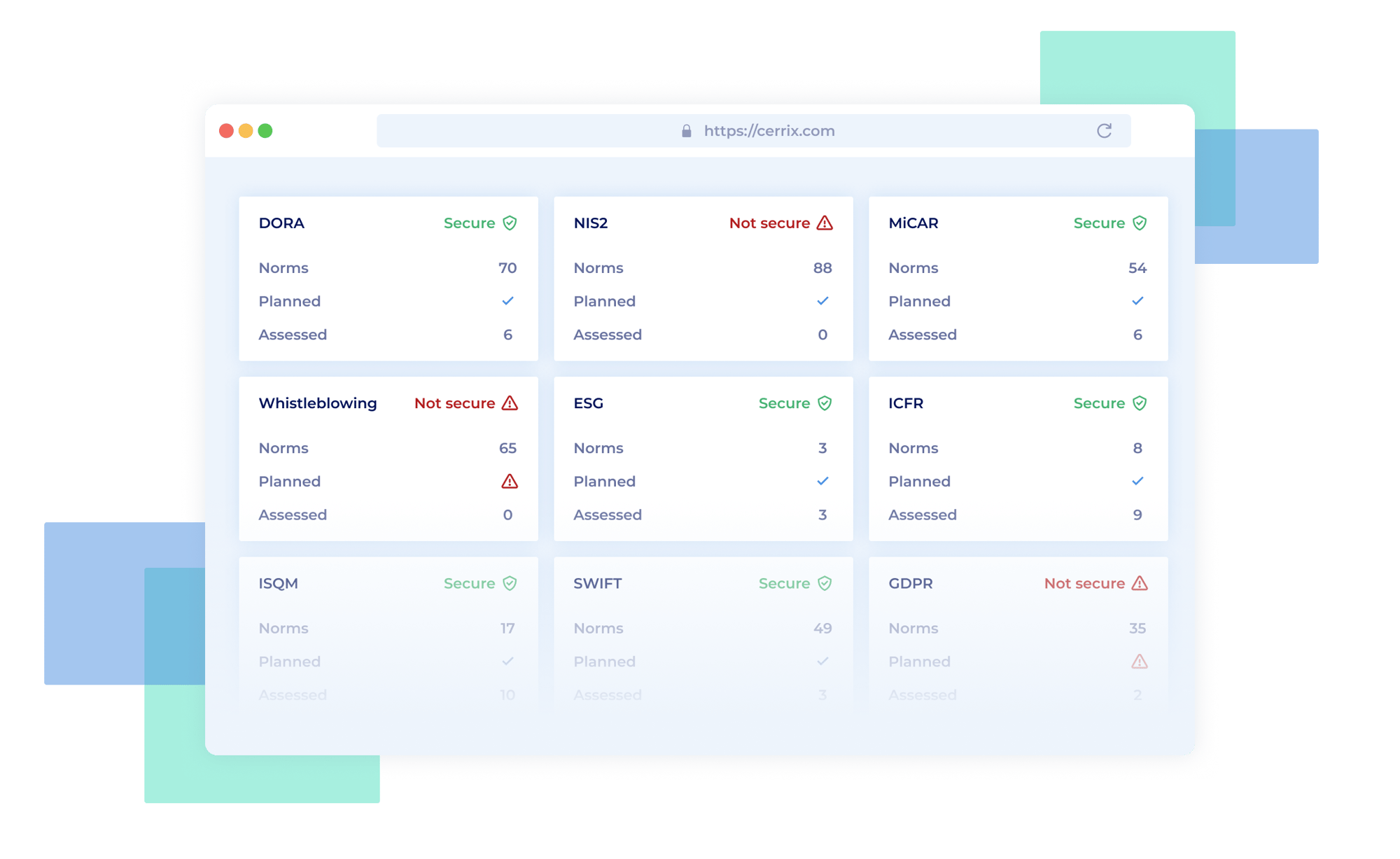

Built-In Compliance Frameworks for Risk Management

CERRIX embeds regulatory frameworks directly into the system, following a "test once, comply many" approach. This ensures effortless compliance across multiple regulations while helping you control risks, streamline audits, and stay ahead of evolving requirements.

DORA (Digital Operational Resilience Act)ICFR (Internal Control over Financial Reporting)

NIS2 (Network & Information Security Directive)

Why Leading Financial Institutions Choose CERRIX?

.png)

Wouter van den Hoogen

Enterprise Risk Manager, a.s.r

Over the past 10 years, we've worked closely with CERRIX, while making extensive use of their software solutions. CERRIX has helped us co-develop the GRCA software tailored to our needs. We truly value this partnership that enables us to drive risk management innovation together.