Overwhelmed by compliance? Simplify it!

Navigating the complexities of the Digital Operational Resilience Act (DORA) can be a challenge. But it doesn't have to be. Download our comprehensive DORA handout and get a clear overview to get started!

Are you struggling to navigate the DORA landscape?

Compliance with the Digital Operational Resilience Act (DORA) is mandatory for financial institutions by January 2025. Non-compliance could result in:

Regulatory Penalties: Avoid costly fines and sanctions.Operational Disruptions: Build resilience against ICT failures and cyberattacks.

Reputational Damage: Protect your organization’s trust and market standing.

What is DORA?

The Digital Operational Resilience Act is a groundbreaking regulation designed to safeguard the financial sector from ICT disruptions. It sets a new standard for managing digital risks and ensuring business continuity.

“By 2025, financial institutions must prove they can withstand and recover from ICT disruptions. Are you ready?”

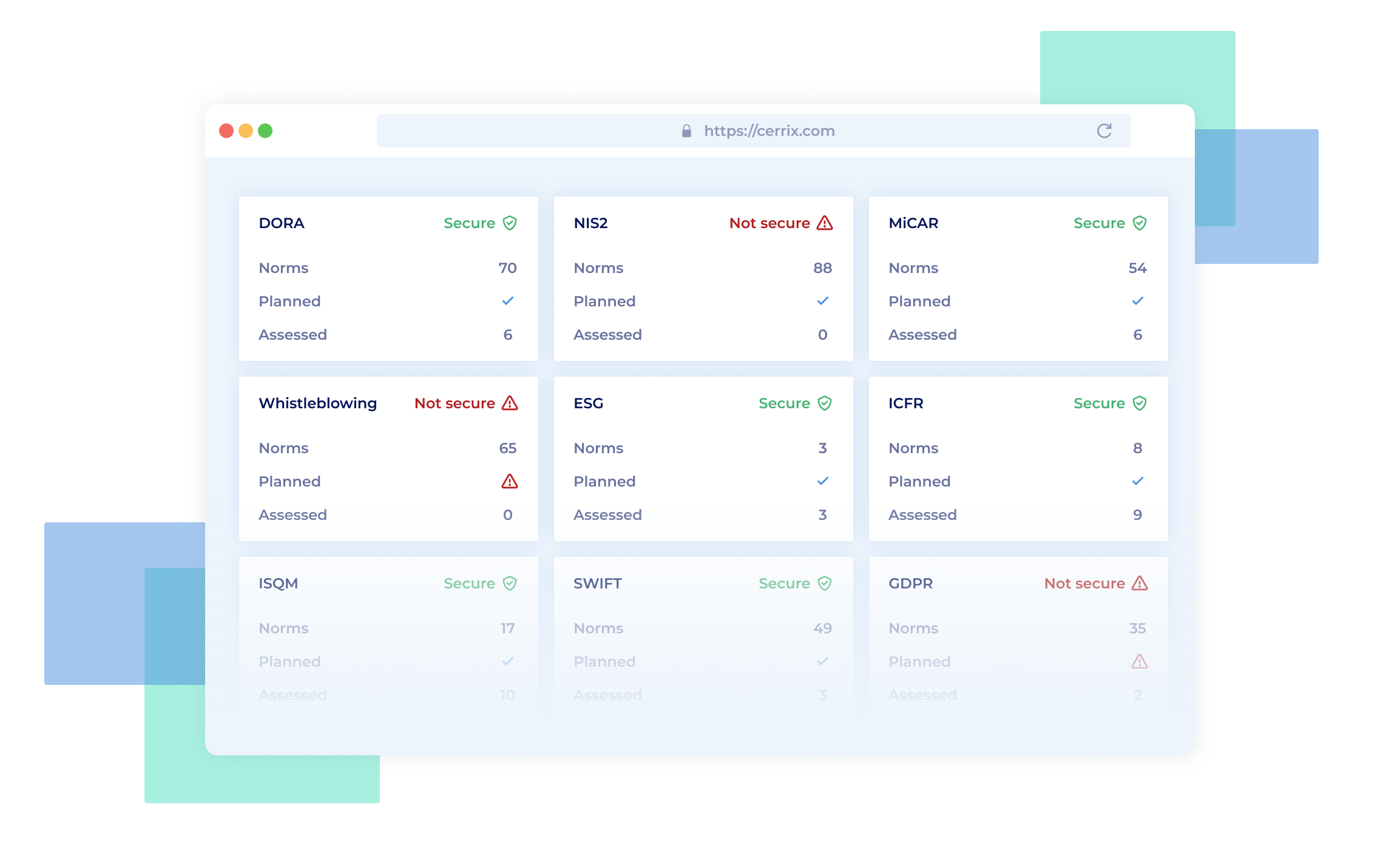

Navigate DORA Compliance with an Integrated Platform

CERRIX offers an intuitive, all-in-one compliance platform designed to simplify DORA compliance and enhance operational resilience, manage compliance cost-effectively and reach the goal.

- ICT Risk Management: Centralize risk identification and monitoring across your organization.

- Incident Reporting: Pre-designed templates for efficient incident tracking and reporting.

- Resilience Testing: Plan, execute, and document control tests effortlessly.

- Third-Party Risk Management: Track vendor performance and mitigate supply chain risks.

- Information Sharing: Generate and share structured reports with stakeholders and regulators.

Download DORA whitepaper

and take the first step towards compliance!

What You’ll Discover in This Whitepaper:

✅ A deep dive into DORA’s five pillars and their impacts

✅ Key challenges in compliance & how to address them

✅ Step-by-step implementation approaches for different business sizes & risk maturity levels

✅ Insights on leveraging technology to streamline compliance

Download the whitepaper now!